Magix.AI - Personal Assistant for Financial Organizations

Share with us some information about your company… When was it established, primary business, current customers, etc.… or if it is newly established, what is the structure and by whom was it founded?

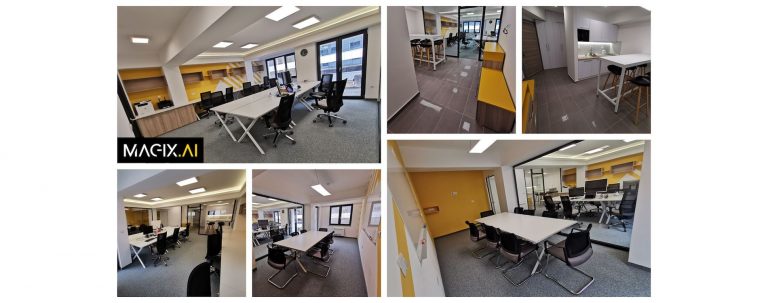

Magix.AI is a fast growing IT company with a focus on products and services in the field of artificial intelligence and machine learning. The company was officially established in Skopje, 2018. The Magix.AI team consists of software engineers, researchers, business analysts, quality control engineers, and UX / UI designers. Additionally, the team is in constant collaboration with academic consultants, who have proven expertise and doctorates in the fields of Artificial Intelligence (AI), Machine Learning (ML), Natural Language Processing (NPL), Big Data and Machine Vision.

The company’s portfolio consists of a number of service-oriented projects related to machine learning (ML) and natural language processing (NPL), developed for clients from Canada (CogniTrek Corp.), Italy (NRGsys), Sweden (Viking Analitics AG) and Estonia. (Holon Technologies).

Can you tell us more about the project for which you received funding from FITD? What exactly is the project about?

Last year we decided to offer solutions on the regional market, such as the tool for analysis of stock trading and the Personal Assistant for Financial Organizations (Chatbot), for which we applied to FITD and received funding under the call Startup 2.

It is an integrated solution that provides written communication in Macedonian with clients through: – website,

– Facebook Messenger,

– mobile application

– or any other communication platform (Skype, Slack or Viber).

The solution has several levels of integration, with the primary using public data from the client’s website to present products and services in conversation with customers. The most sophisticated integration enables connection of the assistant with the e-banking of the banks, whereby the client will be able to communicate for data specific to his profile and the products he uses (accounts, loans, deposits, cards). This includes asking questions about past transactions, calculating updates to depreciation plans and the like.

How long and to what extent is it developing? When at the earliest can we expect MVP (minimum viable product) from the product available to the public?

The product has already been developed at an early stage and can be tested as an MVP. We are currently working on deeper development and implementation of more sophisticated algorithms from Machine Learning and Data Science. The demo is already available and can be tried on our website https://magix.ai/magix-chatbot/.

How much will the additional funding from FITD help you? In which parts of the project will the Fund’s finances help you more precisely?

With the funding from FITD we will be able to bring the product ready for sale and implementation with customers. So in addition to further developing the virtual assistant, we will try to achieve commercialization during the next year.

Is the product / service you plan to develop for the domestic or international market? What is your primary target group?

We are currently developing the virtual assistant in Macedonian and Cyrillic, because we believe that this type of assistants are not available, and that is part of our business plan – to exploit markets that need non-English virtual assistants. This strategic decision is due to the fact that many languages that are not represented, such as English, do not have enough solutions for such more advanced applications. The main target group are companies from the financial sector (banks, insurance, leasing or factoring companies), but with some modifications it can to be used for wider use. In the future, we plan to expand the use of contact centers, customer support and technical support. This includes automating customer center responses where customers often face similar problems, so that technical support would be automated to some extent and made available across multiple channels.